8 Easy Facts About Offshore Trust Services Explained

Wiki Article

The 9-Second Trick For Offshore Trust Services

Table of ContentsExamine This Report on Offshore Trust ServicesThe 9-Minute Rule for Offshore Trust ServicesThe smart Trick of Offshore Trust Services That Nobody is Talking AboutOffshore Trust Services - The FactsRumored Buzz on Offshore Trust ServicesTop Guidelines Of Offshore Trust ServicesOffshore Trust Services Things To Know Before You BuyLittle Known Questions About Offshore Trust Services.

Exclusive creditors, even bigger private corporations, are more amendable to work out collections versus borrowers with difficult and also efficient possession security plans. There is no asset defense strategy that can deter a very motivated lender with limitless money and patience, but a well-designed overseas depend on usually offers the borrower a positive negotiation.Trustee firms charge yearly charges in the series of $1,000 to $5,000 each year plus hourly rates for added solutions. Offshore trusts are except everybody. For lots of people staying in Florida, a residential asset defense strategy will be as reliable for a lot less money. But also for some people dealing with tough creditor troubles, the offshore count on is the best choice to protect a significant amount of possessions.

Debtors might have extra success with an offshore count on plan in state court than in a bankruptcy court. Judgment financial institutions in state court lawsuits might be intimidated by offshore possession security trust funds as well as may not look for collection of assets in the hands of an offshore trustee. State courts do not have jurisdiction over overseas trustees, which implies that state courts have limited treatments to buy conformity with court orders.

3 Simple Techniques For Offshore Trust Services

A bankruptcy borrower have to give up all their assets as well as lawful rate of interests in home wherever held to the personal bankruptcy trustee. A United state bankruptcy court may urge the bankruptcy debtor to do whatever is called for to transform over to the personal bankruptcy trustee all the debtor's properties throughout the world, consisting of the debtor's useful interest in an offshore trust.Offshore property protection depends on are much less reliable against IRS collection, criminal restitution judgments, and also family sustain commitments. The courts might attempt to urge a trustmaker to dissolve a depend on or bring back trust fund properties.

The trustmaker has to be prepared to quit legal rights and control over their count on assets for an offshore depend effectively safeguard these assets from U.S. judgments. 6. Choice of a professional and trusted trustee that will certainly defend an overseas count on is more crucial than picking an overseas depend on jurisdiction.

Some Known Details About Offshore Trust Services

Each of these nations has trust laws that are favorable for offshore property protection. There are subtle lawful differences among overseas depend on territories' laws, yet they have much more attributes in common.

An overseas trust is a traditional count on that is developed under the regulations of an offshore jurisdiction. Usually offshore counts on are comparable in nature and result to their onshore equivalents; they involve a settlor transferring (or 'working out') possessions (the 'trust home') on the trustees to take care of for the benefit of an individual, course or persons (the 'recipients') or, periodically, an abstract function.

Liechtenstein, a civil territory which is often taken into consideration to be offshore, has unnaturally imported the count on principle from common law territories by law. Authorities statistics on trust funds are hard to find by as in the majority of offshore territories (and in the majority of onshore jurisdictions), counts on are not needed to be registered, nonetheless, it is thought that the most common use overseas trusts is as part of the tax obligation and also financial planning of rich people and also their households.

Some Of Offshore Trust Services

In an Unalterable Offshore Trust might not be transformed or sold off by the settlor. A makes it possible for the trustee to select the distribution of revenues for various classes of beneficiaries. In a Fixed trust, the distribution of revenue to the recipients is fixed as well as can not be transformed by trustee.Discretion as well as privacy: Although that an overseas trust is officially signed up in the federal government, the parties of the trust, possessions, as well as the problems of the trust fund are not taped in the register. Tax-exempt status: Possessions that are transferred to an offshore count on (in a tax-exempt offshore zone) are not strained either when moved to the count on, or when moved or rearranged to the recipients.

6 Easy Facts About Offshore Trust Services Described

This has additionally been carried out in a number of united state states. Count on general are subject to the guideline in which provides (briefly) that where depend on residential or commercial property consists of the shares of a company, after that the trustees need to take a favorable duty in the events on the firm. The policy has actually been criticised, yet stays part of trust fund law in several usual regulation jurisdictions.Paradoxically, these specialised kinds of counts on seem to infrequently be used in regard to their original intended usages. STAR depends on appear to be utilized much more frequently by hedge funds developing common funds as device trust funds (where the fund managers desire to get rid of any type of responsibility to attend meetings of the firms in whose securities they spend) as well as VISTA trusts are regularly utilized as a part of orphan frameworks in bond problems where the trustees want to separation themselves from monitoring the providing car.

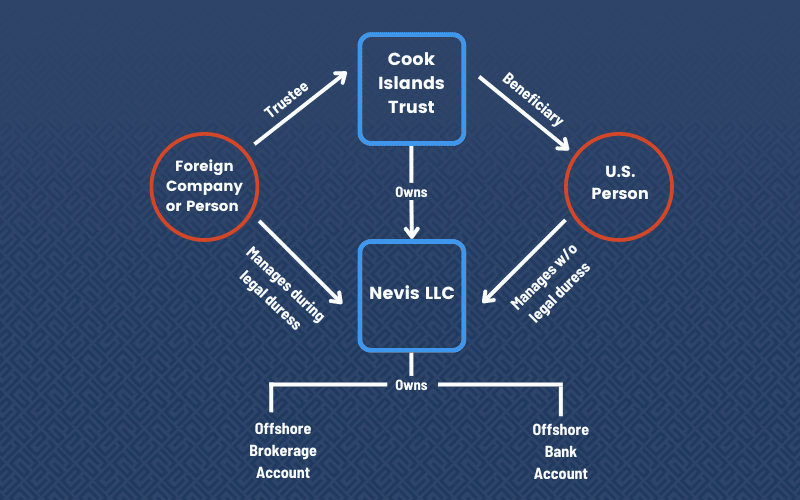

Particular jurisdictions (significantly the Chef Islands, however the Bahamas also has a variety of asset protection trust fund) have actually supplied unique trust funds which are styled as asset protection depends on. While all counts on have an possession defense element, some territories have actually enacted legislations attempting to make life challenging for financial institutions to press insurance claims against the trust (for example, by offering particularly short restriction periods). An offshore trust is a tool used for property defense and estate preparation that works by transferring possessions right into my company the control of a lawful entity based in another nation. Offshore trust funds are unalterable, so trust fund proprietors can not redeem possession of moved assets. They are likewise complicated and costly. For individuals with better obligation problems, offshore trust funds can provide protection and also higher privacy as well as some tax advantages.

The 7-Second Trick For Offshore Trust Services

Being offshore adds a layer of protection as well as personal privacy in addition to the capacity to manage taxes. For example, because the trusts are not located in the USA, they do not have to comply with united state regulations or the judgments of U.S. courts. This makes it extra difficult for lenders as well as plaintiffs to pursue claims against possessions kept in offshore trust funds.It can be tough for 3rd parties to identify the possessions and owners of overseas trusts, which makes them help to personal privacy. In order to establish an offshore depend on, the very first step is to choose a foreign country in which to find the trust funds. Some popular locations include Belize, the Chef Islands, Nevis as well as Luxembourg.

The 6-Minute Rule for Offshore Trust Services

Finally, transfer the properties that are to be safeguarded right into the trust fund. Depend on proprietors might first develop a restricted obligation firm (LLC), transfer properties to the LLC and afterwards move the LLC to the trust fund. Offshore trust funds can be helpful for estate planning and asset protection but they have restrictions.Incomes by possessions positioned in an offshore trust are cost-free of United state taxes. United state owners of overseas counts on likewise have to submit reports with the Internal Profits Service.

Not known Incorrect Statements About Offshore Trust Services

Corruption can be an issue in some countries. On top of that, it is essential to choose a country that is click here for info not most likely to experience political agitation, program modification, financial turmoil or quick adjustments to tax plans that could make an offshore trust fund less useful. Asset defense counts on typically have actually to be developed before they are needed.They additionally do not flawlessly shield versus all cases as well as might reveal proprietors to dangers of corruption and also political instability in the host countries. Nevertheless, overseas depends on are valuable estate preparation and also asset security tools. Comprehending the appropriate time to utilize a particular depend on, and also which trust fund would certainly supply the most profit, can be complex.

Think about utilizing our source on the trust funds you can make use of to profit your estate planning., i, Supply. com/scyther5, i, Supply. com/Andrii Dodonov. An Offshore Count on is a traditional Count on shaped under the regulations of nil (or reduced) tax Worldwide Offshore Financial. A Count on is a legal game plan (similar to an agreement) whereby one check it out person (called the "Trustee") in line with a subsequent person (called the "Settlor") consents to recognize as well as hold the property to assist various individuals (called the "Recipients").

Report this wiki page